Efficient inventory management is a critical aspect of running a successful e-commerce business. It directly affects your costs, tax obligations, and financial performance. The two most commonly used inventory valuation methods—LIFO (Last-In, First-Out) and FIFO (First-In, First-Out)—help determine how inventory costs are calculated, how profits are reported, and ultimately, how much tax you owe.

Understanding which method aligns best with your e-commerce goals requires a solid grasp of how LIFO and FIFO work, and how they influence your bottom line. Let’s explore these methods in more detail to see how they can be leveraged to optimize your e-commerce business.

Key Takeaways

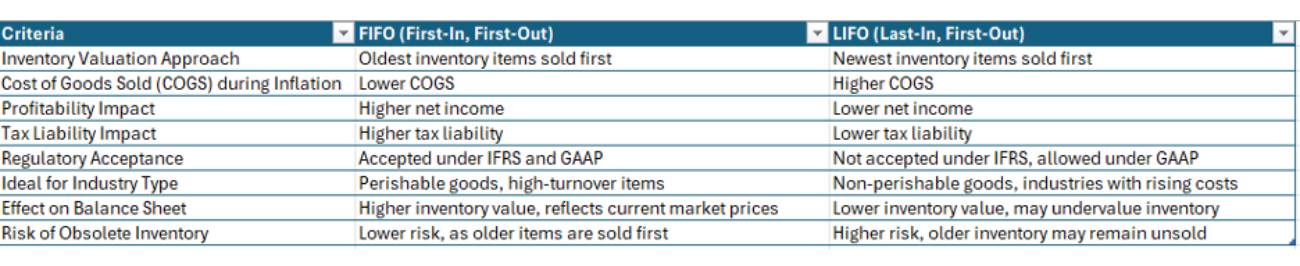

- Inventory Management Impact: LIFO (Last-In, First-Out) and FIFO (First-In, First-Out) are inventory valuation methods that significantly influence cost management, taxes, and profitability for e-commerce businesses.

- LIFO Overview: LIFO assumes the most recent inventory is sold first, leading to higher cost of goods sold (COGS) and reduced taxable income in times of rising prices, which helps lower tax liability.

- FIFO Overview: FIFO assumes the oldest inventory is sold first, leading to lower COGS, higher net income, and potentially higher taxes, making it ideal for businesses that need to sell items quickly.

- Choosing the Right Method: Your choice depends on factors like industry type, tax strategy, and financial goals—FIFO is better for perishable goods, while LIFO can be advantageous during inflation.

Understanding LIFO (Last-In, First-Out)

The LIFO method assumes that the most recently added inventory items are sold first. This means that during times of inflation, when inventory costs are rising, the latest (and typically more expensive) items are what get sold first. This results in:

- Higher COGS: Because LIFO uses newer, higher-priced inventory, the cost of goods sold is higher, which leads to lower reported profits.

- Reduced Tax Liability: Lower profits mean a lower tax burden. For businesses with slim profit margins or those trying to conserve cash, this can be a strategic advantage.

- Not Globally Accepted: LIFO is allowed under U.S. Generally Accepted Accounting Principles (GAAP) but is not permitted under International Financial Reporting Standards (IFRS). This means it may not be suitable for businesses that plan to expand internationally.

Understanding FIFO (First-In, First-Out)

The FIFO method assumes that the oldest inventory is sold first. This approach aligns with how most businesses naturally manage their stock—selling older items first to avoid spoilage or obsolescence. Key points of FIFO include:

- Lower COGS: By using the cost of older inventory, which may have been purchased at a lower price, COGS is lower, resulting in higher profits.

- Higher Tax Obligations: The increased profit from lower COGS means that businesses may face higher tax liabilities. This can be beneficial for showcasing strong profitability to investors, but it also means more taxes are due.

- Compliance Versatility: Unlike LIFO, FIFO is accepted under both IFRS and GAAP, providing greater flexibility for businesses that operate or plan to operate globally.

How LIFO and FIFO Impact Financial Performance

The method you choose for inventory valuation significantly impacts your financial reporting and tax strategy.

- Tax Implications: In times of inflation, LIFO can help reduce your tax burden because higher COGS means lower taxable income. On the other hand, FIFO could lead to higher taxes since it often results in greater reported profits.

- Financial Reporting: FIFO tends to make a company look more profitable on paper, which can be advantageous if you’re seeking investment. LIFO, however, may show reduced profitability, which can be a drawback for attracting investors but a benefit for reducing tax obligations.

- Balance Sheet Effects: FIFO generally provides a higher inventory valuation on your balance sheet, which may better reflect current market values, whereas LIFO typically leads to lower inventory values because it matches the latest costs to revenue.

When to Use LIFO vs. FIFO in E-Commerce

Choosing between LIFO and FIFO depends on various factors, including industry type, inventory characteristics, and your financial goals.

- Industry Norms: Businesses dealing with perishable goods, such as food items, often use FIFO to ensure products are sold before they expire. LIFO may be suitable for industries with non-perishable items, like electronics, where cost fluctuations impact profitability.

- Economic Environment: In inflationary periods, LIFO may help you minimize tax burdens, while FIFO can increase your profits but also the taxes owed.

- Inventory Turnover: FIFO is ideal for high-turnover goods, ensuring you avoid outdated inventory. LIFO might lead to unsold older stock, which can become problematic if those items are eventually written off at a loss.

Real-World Example for LIFO and FIFO for Seasonal Businesses

Imagine an e-commerce store that specializes in holiday-themed products, including elaborate holiday decorations and holiday pet food items. During the peak season, the costs for materials used in decorations—such as premium-quality ornaments, LED light strings, and specialized wrapping materials—often rise due to increased demand and supply chain constraints. If your business chooses to use the LIFO (Last-In, First-Out) inventory method, the latest inventory purchased at higher prices would be considered sold first.

For example, let’s say your store stocks handcrafted glass ornaments, which become more expensive as the holiday season progresses due to increased raw material and labor costs. Under LIFO, these higher-cost items would be reflected in your Cost of Goods Sold (COGS). This means that your reported profit would be lower during the high-income period, thus reducing your taxable income. The LIFO approach allows you to strategically manage cash flow by reducing your tax liability, which is especially useful in an industry where price fluctuations are common and margins need careful control.

On the other hand, consider items like holiday-themed pet food, such as special holiday turkey-flavored dog treats or festive cat food variety packs. These products are often time-sensitive, as pet owners want to provide fresh treats for their furry friends during the holiday season. If your business uses the FIFO (First-In, First-Out) inventory method, it ensures that the oldest inventory—those purchased earlier when costs were lower—is sold first.

This approach is beneficial in several ways. First, it reduces the risk of waste, as older inventory is prioritized to prevent expiration. Imagine having a large stock of holiday pet treats that are only popular during the festive season. Using FIFO means that the earliest batches are shipped out first, maintaining product freshness and customer satisfaction. Pet owners expect high-quality, fresh treats for their pets, and FIFO helps meet these expectations, ultimately enhancing your brand reputation.

Additionally, during times of rising costs, FIFO results in lower COGS since it uses older, less expensive inventory to calculate the cost of sales. This leads to higher net income, which is advantageous for attracting investors or demonstrating strong financial health to stakeholders. However, it’s important to be mindful that this increased profit also comes with higher tax obligations.

In summary, LIFO can be highly effective for managing high-cost, durable inventory like holiday decorations, helping reduce taxes when material costs spike. Meanwhile, FIFO is ideal for ensuring quality and minimizing waste in perishable, seasonal items like holiday pet food. The choice between LIFO and FIFO depends on the type of inventory and the financial strategy best suited to your business’s unique needs during peak periods.

Future Trends in Inventory Management for E-Commerce

The e-commerce landscape is evolving, and so are inventory management practices. Technologies such as AI and machine learning are transforming inventory valuation by providing predictive analytics that help businesses anticipate which inventory method will be more beneficial at different times. Additionally, blockchain technology is increasing transparency in inventory management, helping businesses keep accurate records and make more informed decisions between LIFO and FIFO.

Making the Right Choice for Your E-Commerce Business

The choice between LIFO and FIFO is not set in stone. As your business grows and market conditions change, it’s important to reassess your inventory valuation strategy periodically. Start by considering your financial goals—whether you want to minimize tax obligations or boost reported profits to attract investors. Next, evaluate how your inventory turnover and industry norms align with LIFO or FIFO.

Remember, the best approach is to remain flexible. Inventory valuation is a tool that, when used effectively, can contribute significantly to the financial health and growth of your e-commerce business.

Frequently Asked Questions (FAQs)

What is the main difference between LIFO and FIFO?

LIFO assumes the newest inventory is sold first, leading to higher COGS during inflation, while FIFO assumes the oldest inventory is sold first, resulting in lower COGS.

Why is LIFO not accepted internationally?

LIFO is not accepted under International Financial Reporting Standards (IFRS) because it can distort financial reporting by undervaluing inventory, making it harder to compare across businesses internationally.

Which method results in lower taxes during inflation?

LIFO results in lower taxable income during periods of rising prices, thereby reducing taxes.

Can I switch between LIFO and FIFO?

Yes, but it requires approval from tax authorities, and you must demonstrate a valid reason for the change. Frequent changes may complicate financial reporting.

Which method should I use for perishable goods?

FIFO is ideal for perishable goods, as it ensures the oldest stock is sold first, reducing waste.

Does using FIFO always mean higher profits?

Not always. While FIFO often results in higher profits during inflation, if prices drop, COGS could increase, leading to lower profits.

How does LIFO affect my balance sheet?

LIFO typically results in lower inventory values on the balance sheet, which might not reflect the true market value, especially in times of rising costs.

Is FIFO better for small businesses?

FIFO is often simpler and more intuitive, making it suitable for small businesses, especially those with high inventory turnover or perishable products.

What are the tax implications of using FIFO?

During inflation, FIFO results in higher profits and consequently higher tax liabilities. It’s important to plan for these tax implications if you choose FIFO.

How do I decide which inventory method is best for my business?

Consider your industry, inventory type, cost trends, and financial goals. Consult with a financial advisor to determine which method aligns best with your long-term strategy

Additional Resources for FIFO and LIFO in E-Commerce

To further enhance your understanding of LIFO and FIFO balancing costs and their impact on e-commerce, here are some valuable resources:

- Badger Fulfillment Group’s Guide to Inventory Management: This comprehensive guide provides insights into effective inventory management strategies, helping e-commerce businesses optimize their operations.

- Badger Fulfillment Group’s Blog: Explore a variety of articles covering topics related to e-commerce, fulfillment strategies, and inventory management to stay updated with the latest trends and best practices.

- Investopedia: FIFO and LIFO Accounting Methods: A detailed explanation of FIFO and LIFO accounting methods, including their advantages and disadvantages.

- IRS: Inventory Valuation Methods: The official IRS publication explaining different inventory valuation methods and their tax implications.

- Harvard Business Review: The Essentials of Inventory Management: An article discussing the core principles of inventory management, including the importance of choosing the right valuation method.

By utilizing these resources, you can gain a deeper understanding of how LIFO and FIFO inventory valuation methods affect your e-commerce business, helping you make informed decisions to balance costs and maximize profits.